On January 1, 2025 the gas transit agreement between Ukraine and Russia ended, which means that Russian gas stopped flowing to Europe via Ukraine. This gas route has been operated for five decades. Geopolitically Correct looks at the consequences for European countries and the implications for governments and businesses.

Here’s what you'll discover:

What Does This Mean for Ukraine and Russia?

How Dependent Is the EU on Russian Oil and Gas?

Energy as a Weapon: Lessons from Europe’s Past

What Does This Mean for Ukraine and Russia?

Since the start of the war in Ukraine, the European Union has steadily reduced its dependence on Russian oil and gas.

FOR GOVERNMENTS. Russian pipeline gas accounted for the largest share of EU purchases of Russian fossil fuels at 47% in October 2024. Gas transported via Ukraine accounts for five percent of the EU's total gas imports. In a report published in December, the EU considered the impact of the gas transit deal end to be limited. However, the situation is different for some Eastern European countries. Moldova is feeling the impact directly, and the country declared a 60-day state of emergency in early December in anticipation of the gas cut. Slovakia is also affected. But other countries, such as Austria, have prepared well and diversified their sources by importing LNG via Italy and Germany.

FOR BUSINESS. The end of the gas deal has implications for Russia. It is estimated that the loss of revenue from one of its remaining gas pipeline routes to Europe will reduce revenues by about USD 6 million per year. For Ukraine, it is a strategic decision to stop indirectly supporting Russia by allowing gas to pass through its territory. However, it will miss out on transit fees and will lose the position of being a transit route for Russian gas to European countries. For companies, the end of the gas deal could mean higher energy costs. Especially if EU gas storage facilities are depleted. But for now, the EU energy market remains stable. European Commission spokesperson Anna-Kaisa Itkonen said that: “The markets had already factored in the end of the transit agreement. And we have not seen price spikes in the new year”.

How Dependent Is the EU on Russian Oil and Gas?

In October 2024 the EU was the fourth largest buyer of Russian fossil fuels. The total imports accounted for 13% of the top five purchasers. The total amount in October 2024 which Russia earned by that was EUR 1.8 billion.

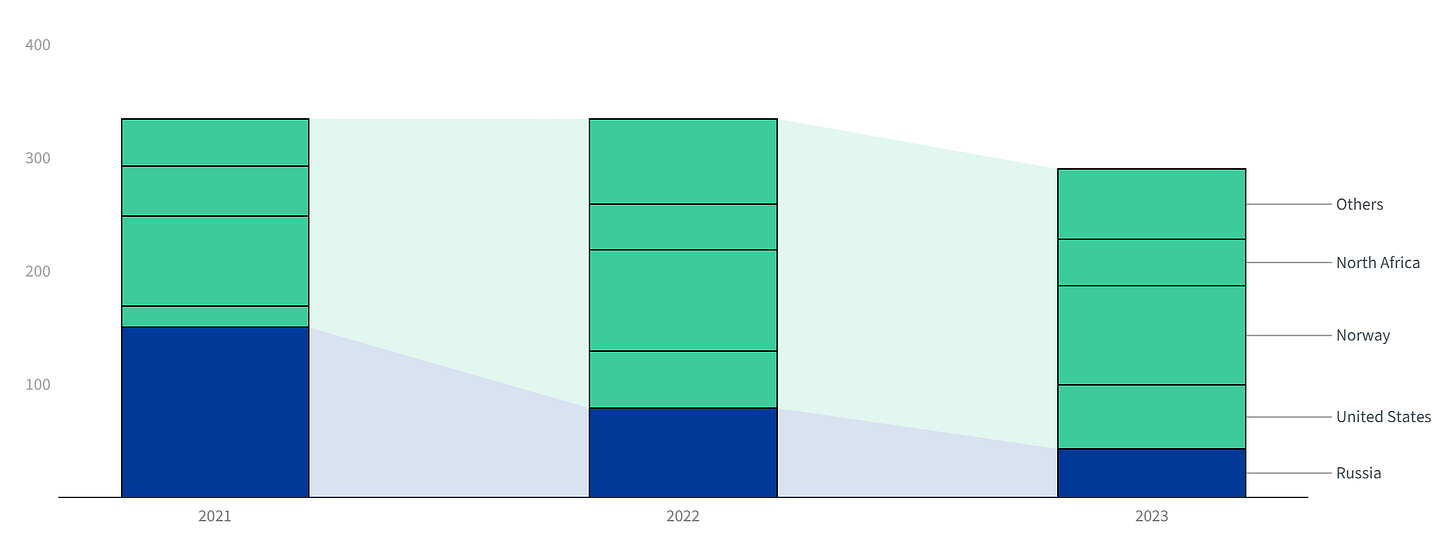

FOR GOVERNMENTS. Russia’s invasion of Ukraine and its conflict with Europe meant that the weaponisation of energy was a threat to the EU. Therefore, the EU made diversification of energy supplies a necessity. Since 2022 we saw the effects of this. The imports of pipeline gas coming from Russia diminished. At the same time the volumes of LNG imports from other countries like the US or Norway increased.

FOR BUSINESS. In 2021 the EU imported 40% of gas through Russian pipelines. In 2023 this number has dropped to only 8%. And even if pipeline gas and LNG combined, the EU imported less than 15% of its total gas imports from Russia. With the end of the transit deal in Ukraine, this has dropped even more. However, this comes with a price. After Ukraine stopped transiting Russia’s gas to Europe, gas prices rose by 4.3%. And European natural gas futures were the highest since October 2023. In general, the war in Ukraine has generated a sharp increase in energy prices in the EU and made the market more volatile as the chart below shows:

Companies in the steel, cement, petrochemicals and other energy-intensive sectors have to cope with high energy costs and cannot pass them on to their customers in full if they are to remain competitive in the global market. This leads to reduced production. In Germany, production in the energy-intensive manufacturing sector was more than 17% lower in July 2024 than before the invasion. Production in this sector is hit harder than during the first wave of the pandemic in 2020.

Energy as a Weapon: Lessons from Europe’s Past

Energy as a weapon has been used following the Russian invasion of Ukraine in 2022. But the tactics to weaponize energy are not new. In Europe it even predates Putin’s presidency.

FOR GOVERNMENTS. The weaponisation of energy can be understood as the strategic manipulation of energy resources for political and/or economic gain. In Europe, the weaponisation of energy has been evident since the early 1990s. For example, the Soviet Union created a network of pipelines across the entire Union. After the collapse of the USSR, the former Soviet states were dependent on this network of pipelines, which were still controlled by Russia. This created a degree of dependency and vulnerability to Moscow’s use of energy as a foreign policy tool. When Lithuania declared independence on 11 March 1990, Russia cut off oil supplies to Lithuania in an attempt to undermine the decision. It also warned the other Baltic states that they would face similar sanctions if they supported Lithuania. Over the years, Russia's use of energy to further its interests became more nuanced and market manipulation more difficult to detect.

FOR BUSINESS. In 2018, an antitrust investigation by the European Commission found that Gazprom had imposed unfair prices on Bulgaria, Estonia, Latvia, Lithuania and Poland. A year later, Bulgaria also had to pay the highest gas prices in Europe due to Gazprom’s unfair pricing. Interestingly, gas price hikes have often coincided with political developments that have been detrimental to Moscow's interests, as seen in Ukraine or other post-Soviet countries such as Belarus or Moldova. Businesses in Europe are suffering from higher energy costs due to the weaponization of energy. It is therefore a success for the EU that it has drastically reduced its energy dependence on Russia since February 2022 as shown below:

However, companies are still struggling with higher energy costs, as LNG from the US, for example, is more expensive than Russian oil and gas. But the diversification of energy sources makes the European energy system less vulnerable to Russia weaponising energy.

Weekly Thought Provoker

Want the full analysis? Subscribe to Geopolitically Correct on YouTube, Spotify, Apple Podcasts, or your preferred platform.

In Review

Here’s what we covered last week:

Chokepoints and Critical Infrastructure Risks

Security and Commercial Impacts

Undersea Threats: Lessons from History